Alarming bell

Major crises are first felt, then they strike by themselves, then many do not know what has happened. Something similar has happened to our economy for the last four years and now the results are coming fast. Slowly, very quietly, a digital or computerized and mobile phone system has come into existence regarding the economy. There has been a lot of discussion in this regard and the results of making the State Bank more independent are also in view. In the eyes of experts, global moneylenders have succeeded in meeting their conditions, but there is little discussion on the point of how all this is changing our economy and whether this change is in everyone’s interest or not. Technological advancements have created serious threats to middle agents or middlemen in various business sectors.

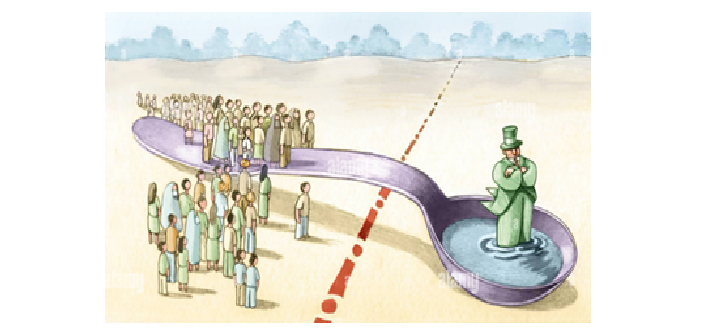

Recently, a report was published regarding millions of distributors and selling agents of several large multinational companies. The report noted that typical general stores are increasingly being linked to both wholesale and retail businesses of large business families. This has resulted in a reduction of 20 to 25 percent in sales by middlemen. There are more than 500,000 people across the country who visit shops in cities and rural areas to take orders and deliver goods. Now, thanks to the technological advancement, the shopkeepers directly order the goods from the company. Now shopkeepers order goods through apps and the company delivers within 24 hours. In this case, the shopkeepers get the goods cheaper as the wholesaler does not have to spend on middlemen’s salaries and other expenses. This practice is cutting the business of the middleman. Quite simply, the small shopkeeper or any other person will buy goods wherever he can find them cheap.

Looking at the trend of the situation, it is estimated that the middlemen can stay in the field at the same time when they also give the goods to the small shopkeepers cheaply. This is very difficult because manufacturers usually give large amounts of goods to large companies. These companies also establish a monopoly together. It is not possible for the common middleman to compete with them. The average middleman does not have enough capital to buy large quantities of goods and sell them cheaply. And even if a few middlemen get together to establish an organization, even a small wave of fluctuations in the market can wash away everything. Large companies can invest well in technological matters. Small entrepreneurs i.e. middlemen are not in a position to do this. They cannot compete at all, at least in the field of technology. From this point of view, a huge change is taking place in the economy as the role of the middleman is disappearing.

The real trouble is that the changes that occur as a result of technological progress cannot be stopped by any law. No law can be made that shopkeepers buy from middlemen instead of buying goods directly from wholesalers. In this case they cannot be bound. The market is driven by the game of cost, delivery of goods, demand, and profit. Middlemen either give the goods cheaper or give something extra along with the goods then the shopkeepers and common people can be attracted towards them otherwise whoever wins the game of cost and selling price all the customers will go to him. Big business seems to be winning this game.

Value is related to which party is adding which value to it. For example, a newspaper is prepared in the office, printed in the press, and reaches the home of the reader through many middlemen. These middlemen get a share of the price the readers pay for the newspaper. If the middlemen are removed, the price of the newspaper will decrease. With the help of the internet, the newspaper does not have to pay much to the readers on computers or mobile phones because there is no middleman.

Technological development is not only cutting the business of the middleman, but also many other threats are emerging. It is important for investors to understand these risks. They understand something. Shares of companies associated with technological development (i.e. technological progress) are also now in the market. Companies related to buying and selling of food items and other daily use items are getting more acceptance. A large amount of investment is being made in them. Most investors feel that investing in tech companies is the best strategy as the rate of return will continue to increase.

A lot goes into any company’s ability to make a profit. Before investing heavily in shares of tech companies, investors should consider whether doing so will put their capital at risk. Any company can be attractive only as long as it earns high profits. If the ability to earn profits weakens, investors start turning away from it. This is a completely natural matter. This is the reason why the stock market fluctuates day by day. The same is the case with tech companies.

Technological progress in itself is many things but not everything. If a company is technically very good today, it does not mean that it will always be profitable. Shares of some tech giants are incredibly valuable, but there’s no one to save them when they crash. Currently, investors are increasingly attracted to technology companies. It all looks great, but it’s also very dangerous. A lot of things change very quickly in the world of technology, which is why many big tech companies emerge quickly and then disappear just as quickly. The work in the field of research and development is happening so much and so fast that it is very difficult for a technological company to keep up with the times even if it tries hard. Any technology can be used to advance, but not necessarily every technology will give us something. Sometimes technology takes too much.

Investors will now have to be very careful. Businesses that are using technology to cut out middlemen are creating a huge crisis. It is necessary to think to deal effectively with this crisis. Middlemen in every sector have to think about how they will be able to survive and continue to work in a rapidly changing economic structure. If all the people in between the producer and the final consumer move out, new confusion may arise for the economy. It is good for the common shopkeeper or retailer to get the goods cheaper, but it remains to be seen whether the benefit is also passed on to the end user or not. If not, then all this effort is useless. If the retailer increases his profit by eliminating the profit of the middleman, only the final consumer will be the loser. The minds improving the economy will have to think in this regard as well.